Bully Tee Blog

Your go-to source for everything related to bullies and tee culture.

Marketplace Liquidity Models: The Undercover Agents of Financial Flow

Discover how marketplace liquidity models drive financial flow and unlock hidden opportunities in the market. Dive into the secrets now!

Understanding Market Microstructure: How Liquidity Models Drive Financial Efficiency

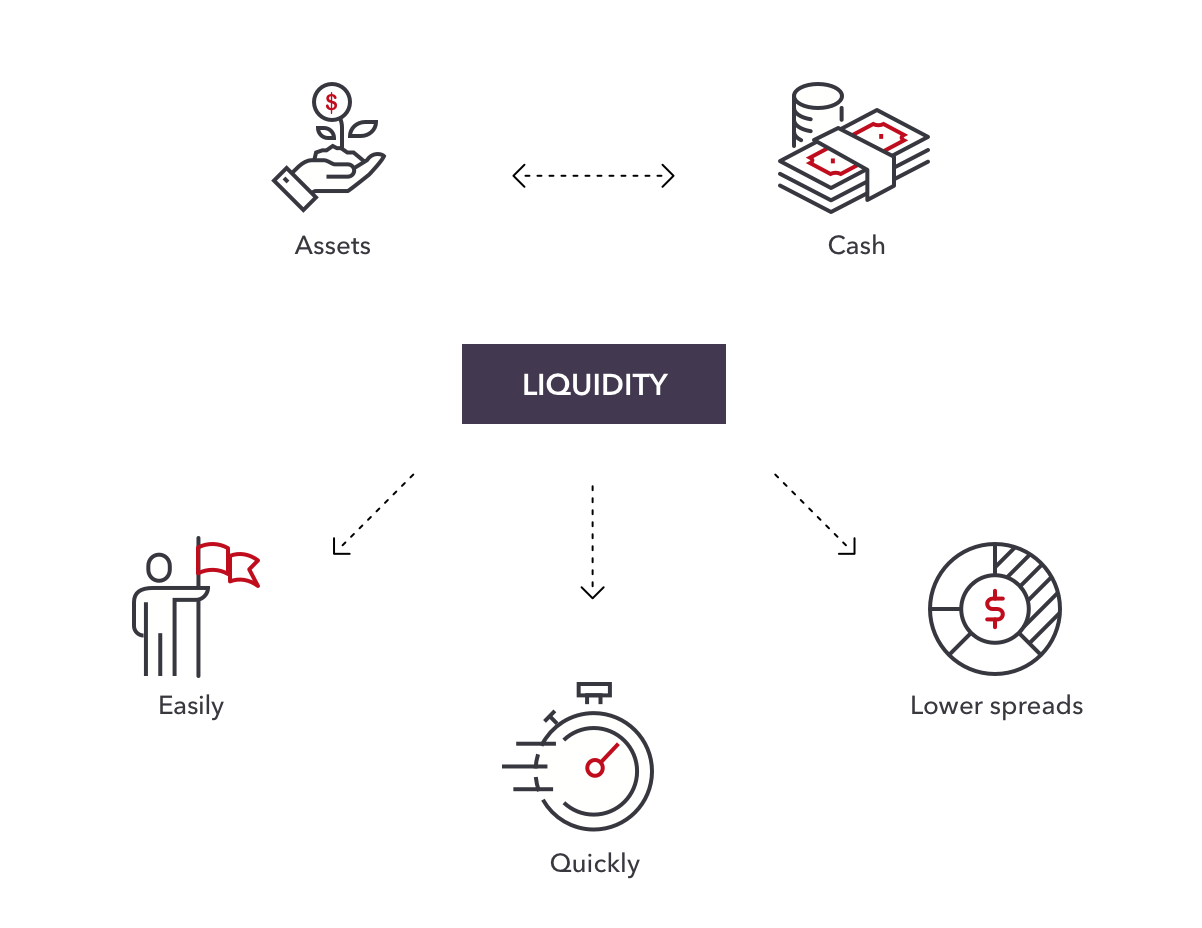

Understanding market microstructure is crucial for grasping how financial markets operate at a granular level. Market microstructure seeks to explain the processes and mechanisms that facilitate trading in securities, particularly focusing on the behavior of market participants and the formation of prices. A vital component of this study is liquidity models, which are essential in analyzing how easily assets can be bought or sold without causing significant price changes. These models provide insights into market efficiency, helping traders and investors assess the impact of liquidity on their trading strategies.

By integrating liquidity models into their analyses, market participants can enhance financial efficiency, which ultimately leads to a more stable and transparent market. For instance, during periods of low liquidity, trading costs can rise, and price volatility tends to increase, affecting overall market stability. Therefore, understanding how liquidity influences market dynamics is not just an academic exercise; it is a practical concern for investors seeking to optimize their portfolios and minimize risk. Moreover, advancements in technology and trading algorithms are continuously reshaping these liquidity models, making it imperative for market participants to stay ahead of the curve.

Counter-Strike is a popular multiplayer first-person shooter game that has gained a massive following since its initial release. Players can engage in intense team-based battles where strategic planning and quick reflexes are essential for victory. If you're looking to enhance your gaming experience, consider checking out the daddyskins promo code for some exciting in-game perks.

The Role of Market Makers: Guardians of Liquidity in Financial Markets

Market makers play a crucial role in ensuring the liquidity of financial markets. By continuously quoting both buy and sell prices, they create a marketplace for assets, allowing traders to execute transactions with minimal delay. This activity not only facilitates smoother trading but also helps to narrow the bid-ask spread, making markets more efficient for participants. Without these intermediaries, the potential for significant price fluctuations would increase, making it difficult for traders to buy or sell without drastically impacting the market.

One of the primary responsibilities of market makers is to absorb excess supply and demand, effectively acting as a buffer during times of volatility. In doing so, they help maintain stable prices and provide a level of predictability for investors. The presence of market makers ensures that traders can enter and exit positions without significant price disruptions, ultimately enhancing overall market confidence. Their function is particularly vital in less liquid markets, where the absence of active buyers or sellers could lead to inefficiencies and increased transaction costs.

How Do Liquidity Models Affect Trading Strategies and Market Stability?

The relationship between liquidity models and trading strategies is crucial for understanding market behavior. When traders assess liquidity, they often consider the liquidity model that best fits their trading approach. For instance, a high-frequency trader may prefer a model that emphasizes instant execution and tight spreads, while a long-term investor might prioritize models that offer stability and less volatility. The choice of liquidity model can thus directly influence trading strategies, as it determines how traders perceive market opportunities and risk. This adaptability allows traders to navigate different market conditions effectively.

Furthermore, liquidity models play a significant role in overall market stability. When liquidity is high, it generally leads to narrower bid-ask spreads and less price slippage, fostering a more stable market environment. Conversely, in periods of low liquidity, even substantial trades can lead to dramatic price swings, which can compromise market efficiency. This dynamic highlights the importance of understanding how liquidity models affect trading strategies; traders must adjust their tactics to accommodate varying levels of liquidity to maintain market equilibrium and ensure their strategies remain effective.