Bully Tee Blog

Your go-to source for everything related to bullies and tee culture.

Flip the Script: A Clever Approach to CS2 Trading Reversals

Discover the secrets of CS2 trading reversals! Flip the script and turn market trends to your advantage with smart strategies and insights!

Understanding CS2 Trading Reversals: Key Concepts Explained

In the world of CS2 trading reversals, understanding the key concepts behind market movements is crucial for making informed decisions. Trading reversals occur when the price of a trading asset changes direction, signaling a shift in market sentiment. Traders often look for signs such as a sudden spike in volume or the formation of reversal patterns on candlestick charts, such as *head and shoulders* or *double tops*. Recognizing these patterns early can provide a significant advantage, allowing traders to enter or exit positions at optimal times.

One of the most effective strategies for identifying potential CS2 trading reversals is to utilize technical indicators. For instance, the *Relative Strength Index (RSI)* can highlight overbought or oversold conditions, which are often precursors to reversals. Likewise, moving averages can help smooth out price action and reveal trends. It is important for traders to combine these indicators with market news and economic data to avoid false signals. By mastering these concepts, traders can enhance their ability to predict market shifts and make strategic trading decisions.

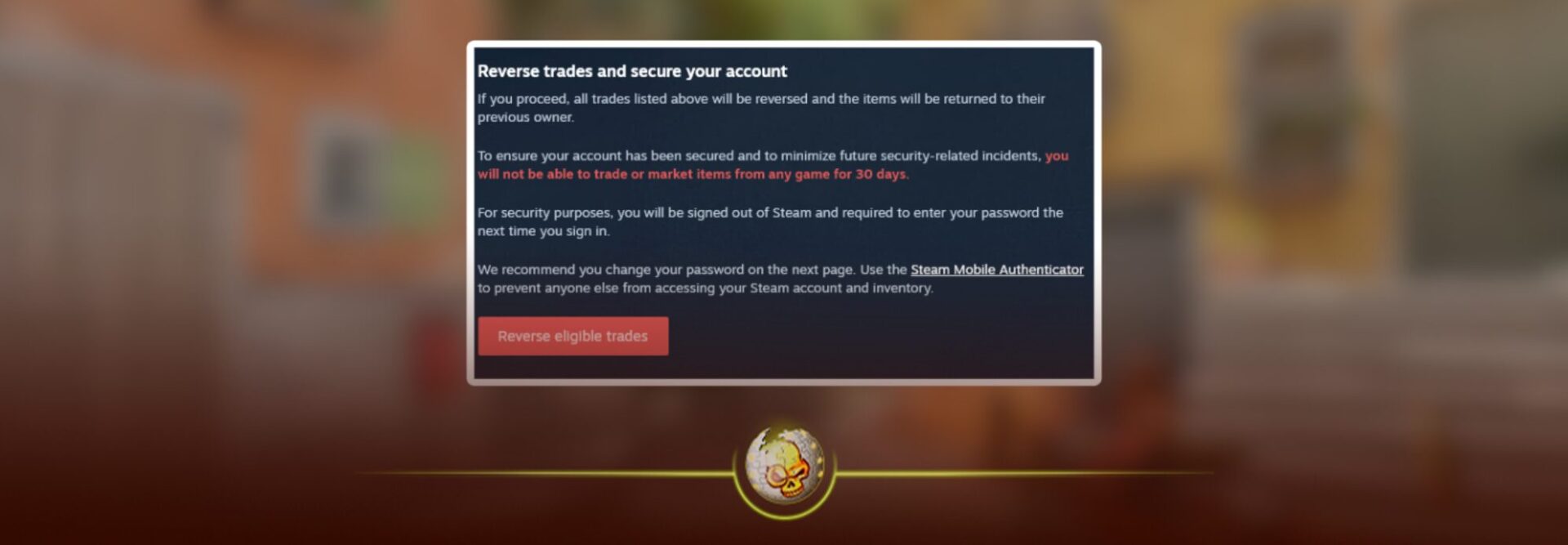

Counter-Strike is a popular tactical first-person shooter game that emphasizes teamwork and strategy. Players can choose to be part of the terrorist or counter-terrorist teams, engaging in various game modes and objectives. For players interested in enhancing their trading skills within the game, a useful trade reversal guide can provide valuable insights. The game has a strong competitive scene, and skillful gameplay often distinguishes the best players from the rest.

5 Common Mistakes in Trading Reversals and How to Avoid Them

When trading reversals, many traders make the common mistake of relying solely on technical indicators. While indicators can provide valuable insights, it’s important to consider market sentiment and fundamental analysis as well. Ignoring these factors can lead to misinterpreting market signals and result in poor trading decisions. To avoid this pitfall, traders should incorporate a holistic approach, analyzing price patterns, volume, and news events that can influence market direction.

Another frequent error is the failure to set stop-loss orders. Traders often let emotions dictate their decisions, holding onto losing trades in hopes of a reversal, which can lead to substantial losses. Implementing a solid risk management strategy, including the use of stop-loss orders, allows traders to limit their potential risks. Remember, it’s crucial to stick to your trading plan and not let fear or greed steer you off course.

How to Identify the Best Opportunities for CS2 Trading Reversals

Identifying the best opportunities for CS2 trading reversals requires a keen understanding of market trends and player behavior. Start by monitoring price fluctuations on trading platforms and utilize technical analysis tools to spot potential reversal points. Key indicators such as moving averages and the Relative Strength Index (RSI) can provide valuable insights into when a price might be oversold or overbought. Additionally, pay attention to community discussions and updates from developers, as news can significantly impact item prices and trading opportunities.

Another effective strategy for pinpointing profitable CS2 trading reversals is to analyze historical price data. Look for patterns in the market that indicate a propensity for certain items to revert to a previous price level. Consider creating a watchlist of high-demand items and tracking their prices over time. Utilizing tools like trading bots or market alert systems can also help you stay updated on price changes in real-time, allowing you to act swiftly when a reversal opportunity arises.