Bully Tee Blog

Your go-to source for everything related to bullies and tee culture.

Why Your Landlord's Insurance Isn't Enough to Save You

Discover the shocking truth: why relying on your landlord's insurance could leave you vulnerable. Protect yourself today!

What Landlord's Insurance Covers: The Gaps You Need to Know

Landlord's insurance is essential for property owners looking to protect their investments, but it's crucial to understand exactly what it covers. Generally, this type of insurance provides coverage for the physical structure of the rental property, including protection against damages caused by natural disasters, fire, or vandalism. However, many policies do not cover certain situations such as tenant-caused damages or wear and tear. Additionally, some landlords may overlook the importance of liability coverage, which can protect them in case a tenant or visitor is injured on the property. Understanding these key areas can help you avoid the gap in coverage that could leave you financially exposed.

Moreover, it's vital for landlords to evaluate optional coverages that might be necessary depending on the specific circumstances of their rental properties. For instance, loss of rental income coverage provides financial support if your property becomes uninhabitable due to repairs or damage. Another critical aspect to consider is personal property coverage, which can protect items you may provide for tenants, such as appliances or furniture. Assessing these gaps ensures that you are adequately covered from potential risks and can prevent costly out-of-pocket expenses.

5 Reasons Why Relying Solely on Your Landlord's Insurance Can Put You at Risk

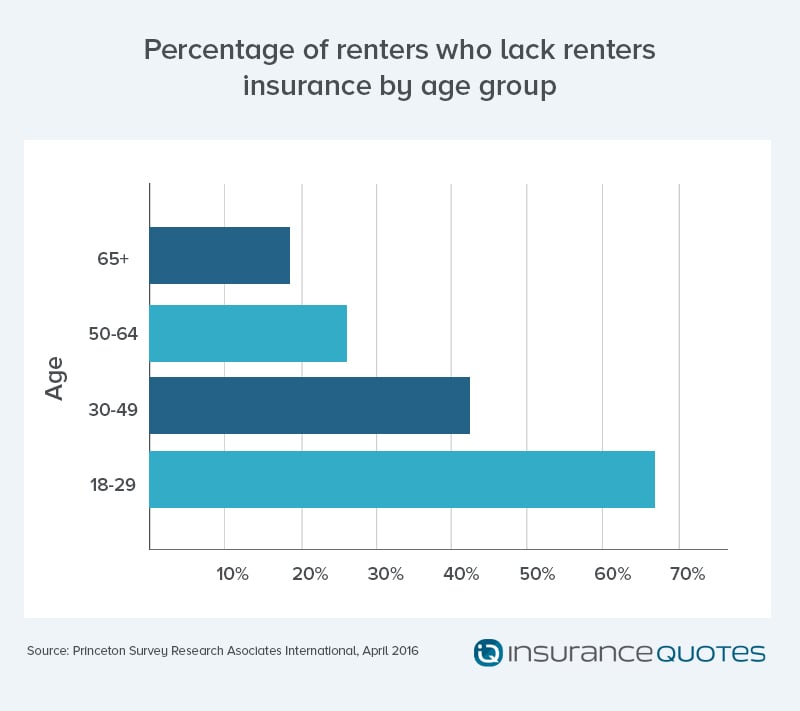

Relying solely on your landlord's insurance can expose tenants to significant risks, especially when it comes to personal property protection. While your landlord's policy typically covers the building itself, it often excludes tenant belongings. In fact, most landlord insurance policies are designed to protect the property owner and their investment, not the personal items of tenants. This means that in the event of a fire, theft, or natural disaster, your personal belongings may be left unprotected. Therefore, it's essential for tenants to consider obtaining their own renters insurance to ensure their possessions are safeguarded.

Additionally, landlord's insurance may not cover liability claims that could arise from incidents occurring within the rental unit. For instance, if a guest is injured while visiting, the landlord's policy may not provide coverage for the tenant's legal liabilities. This gap can leave tenants facing hefty expenses and legal challenges. To mitigate this risk, tenants can secure a renters insurance policy which often includes liability coverage, ensuring peace of mind in case of unforeseen accidents. Overall, it's crucial to recognize that depending solely on your landlord's insurance could lead to potentially devastating financial implications.

Is Your Safety Net Strong Enough? Understanding the Limitations of Landlord's Insurance

The safety net of landlord's insurance can provide essential coverage for property owners, but it's crucial to understand its limitations. While this type of insurance typically protects against property damage, liability claims, and loss of rental income, it may not cover everything a landlord faces. For instance, policies might exclude certain natural disasters, tenant-related damages, or even legal expenses associated with eviction processes. Without a comprehensive understanding of what is included and what is not, landlords could be left vulnerable when the unexpected occurs.

Moreover, it's important to routinely review and update your landlord's insurance policy. As laws, tenant expectations, and rental markets evolve, so should your coverage. Consider conducting periodic assessments of your property's value and the risk factors that may affect it. Implementing additional layers of protection, like umbrella insurance or specific endorsements for unique situations, can help fortify your safety net. Ultimately, a proactive approach ensures that your insurance adapts to the changing landscape, providing peace of mind for every landlord.