Bully Tee Blog

Your go-to source for everything related to bullies and tee culture.

Renters Insurance: Protecting Your Stuff from Uninvited Guests

Secure your belongings from theft and damage! Discover how renters insurance can shield your stuff from uninvited guests today!

What is Renters Insurance and Why Do You Need It?

Renters Insurance is a type of insurance designed to protect individuals who rent their living space, whether it's an apartment, condo, or house. This coverage typically includes protection for personal belongings in the event of theft, fire, or other disasters. Additionally, it provides liability coverage, which can help pay for medical expenses or damages if someone is injured while on your property. Unlike homeowners insurance, which covers the structure itself, renters insurance focuses on the contents within the rented space, making it a vital safeguard for tenants.

There are several reasons why renters insurance is essential for anyone renting a property. First and foremost, it offers peace of mind knowing that your personal belongings are covered against unexpected damages or losses. Furthermore, it is often quite affordable, with many policies costing less than a dollar a day. In many cases, landlords may require tenants to have renters insurance, ensuring that all parties are protected in case of an accident. Ultimately, with the risks associated with renting, investing in renters insurance is a smart choice that can save you from significant financial loss.

5 Common Misconceptions About Renters Insurance Explained

Many individuals believe that renters insurance is unnecessary, often thinking that their landlord's insurance policy covers their personal belongings. However, this is a common misconception. In reality, landlord insurance typically covers the physical structure of the property and any communal areas, but it does not protect the tenant's personal possessions from theft, fire, or other disasters. Renters insurance provides essential coverage for your personal items, including electronics, furniture, and clothing, ensuring you’re financially protected in unexpected situations.

Another prevalent myth is that renters insurance is too expensive. Many people assume that they cannot afford it, yet average premiums can be surprisingly low, often ranging from $15 to $30 a month depending on your location and coverage limits. This cost is minimal compared to the potential financial loss from damaged or stolen property. Moreover, various discounts are available, such as bundling policies or having safety features in your home, making renters insurance an affordable and wise investment for protection.

How Renters Insurance Can Safeguard Your Belongings from Theft and Damage

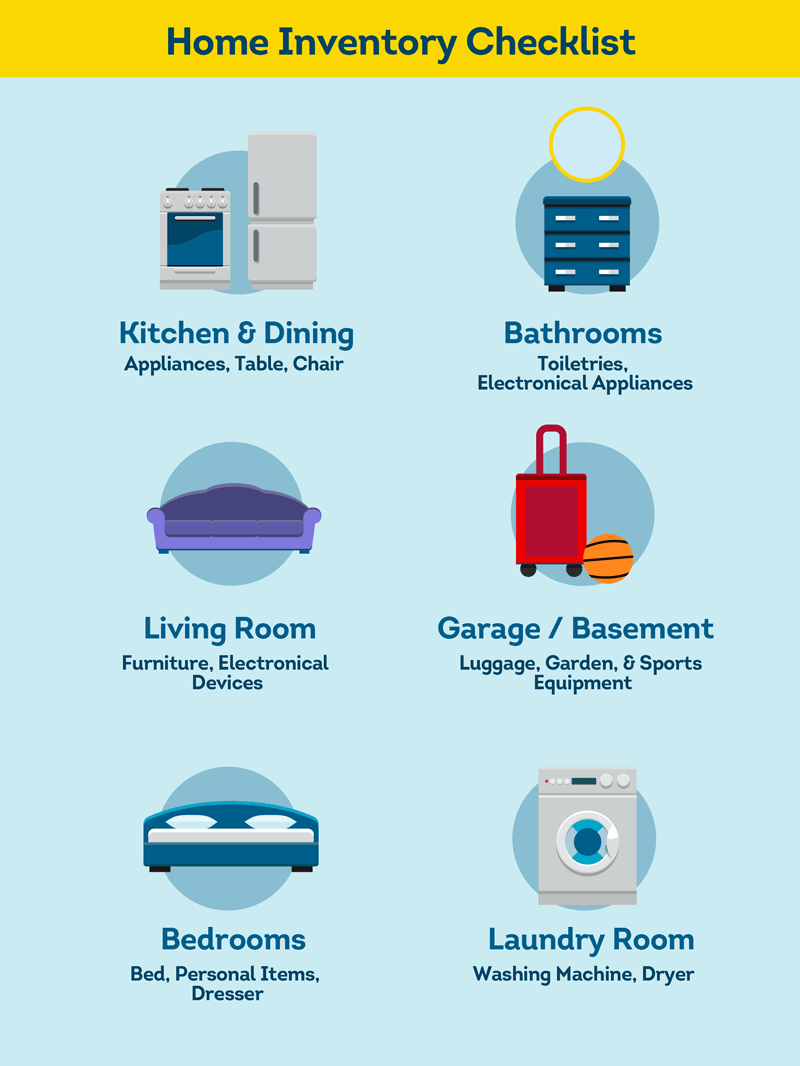

Renters insurance is an essential safeguard for individuals renting a home or apartment, providing peace of mind against unexpected events such as theft or damage. It covers personal belongings like electronics, furniture, and clothing, ensuring that if an unfortunate incident occurs, you won't face financial devastation. For instance, in the event of a break-in, renters insurance can help reimburse you for stolen items, making it a crucial financial tool for protecting your possessions.

In addition to protecting against theft, renters insurance also covers damages due to unforeseen circumstances such as fire, water leaks, or vandalism. This means that if your belongings are damaged or destroyed, you can file a claim to recover the cost of replacements. When selecting a policy, it's important to understand the limits of coverage and consider additional endorsements for higher-value items. With the right renters insurance in place, you can confidently enjoy your rental space, knowing that your belongings are secure.